Equipment Financing, Leasing and Rental

Filter by Process Zone:

Commercial Credit Inc.: One of North Carolina’s Top 40 Mid-Market Companies for the Ninth Consecutive Year

For the ninth time in a row, Commercial Credit Inc. (Charlotte, NC) has made the Business North Carolina Mid-Market Fast 40 List.

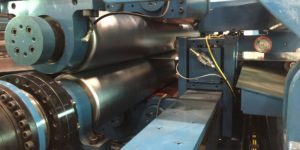

Same-Day Rental on Pipe Welding End Preparation Tools

Esco’s Rental Tools Program puts the full line of MILLHOG I.D., COHOG O.D., and Universal Air Powered Saw and track systems into users’ hands anywhere in the U.S. The tools bevel any degree on all types of alloys in diameters up to 36 inches.

What You Need to Do to Increase Your Chances of Getting an Equipment Loan

A financing relationship is a two-way street. Make potential lending partners comfortable supporting your company’s growth by being able to clearly and concisely explain how a piece of machinery – or machines – will improve productivity and profitability.

Capital Equipment Financing Options to Grow Your Business

Not all capital should be financed the same way, and not all capital funding sources are created equal. An assessment of short-term and long-term needs will help determine which loan type, structure and financing entity is best suited for your company and your expansion needs.

CCG EFL Names New VP

Anthony Zambon now leads their Canadian Division.

Tips to Make the Finance Process Go Smoothly

Every transaction is different, each borrower is unique, and financing companies differ in how they review credit requests. Regardless of the size of the transaction, the quicker you provide the requested documentation and information to the credit team, the quicker they can review and hopefully extend the credit needed for that equipment purchase.

First Veteran to Machinist Scholarship is Awarded

CNC Machines chooses Kevin Bruffet as the recipient of their first-ever Veteran to Machinist scholarship.

Commercial Credit and BDT Close Equity Investment

This deal gives BDT a majority equity stake in one of the largest independent metalworking equipment finance companies in the U.S.

There’s More to Equipment Financing Than Rates

The interest rate is a very small component of overall financing costs. It’s more important to match the lender to your overall financing needs. Here are some key factors that can help you find a good fit for a financing partner.

How to Upgrade Equipment Without Breaking the Bank

Most companies and banks don’t even consider the possibility of using the equity in existing equipment as collateral to obtain new machines and technology. This can have the effect of reducing overall debt service, potentially reducing monthly payments, and improving cash flow – a win-win all around. Here’s how it works.

The Silver Lining of Lease Accounting: What to Know About the New Standard

Leasing and finance are the most common payment method used by businesses to acquire equipment and software. Here are some newly enacted benefits that shops will realize through new changes in accounting and tax laws.

Commercial Funding Launches Spanish Language Website

This new site supports Spanish speaking metalworking business owners in the U.S.