Hang Tight: The Manufacturing Industry’s Expansion is Underway

While the numbers remain steady, the underlying economic message for manufacturers is there is a gradual improvement in new orders.

Posted: August 15, 2023

That rocky road filled with economic uncertainties that metalworkers have been on is showing signs of smoothing. While the overall manufacturing sector remains in a state of contraction, the gap is narrowing. The nation’s purchasing and supply chain executives believe the economy will continue to softly expand for the rest of the year, according to a survey taken in the spring by the Institute for Supply Management (ISM).

While the July manufacturing PMI issued by ISM increased a bit to 46.4%, up from 46.0% in June, when you take a deeper dive, there are signs of additional continued improvements. (A PMI reading above 50% indicates that the manufacturing sector is generally expanding; below 50% indicates that it is generally contracting.) “The U.S. manufacturing sector shrank again, but the uptick in the PMI indicates a marginally slower rate of contraction,” said Tim Fiore, chair of the Institute for Supply Management’s Manufacturing Business Survey Committee.

The July ISM’s manufacturing PMI report shows a bit of an upward trajectory for the New Orders Index, registering 47.3%, an increase of 1.7%, compared to June’s reading of 45.6%. Additionally, the Production Index registered 48.3% in July, 1.6% higher than the June reading of 46.7%.

According to another indicator, the July 2023 Precision Metalforming Association’s Business Conditions Report, metal forming manufacturers’ business activity is expected to remain consistent for the next three months. The report found that 55% of metal forming companies expect no change in general economic activity (compared to 58% in June); 34% predict a decrease in activity (compared to 32% in June); and 11% forecast an increase in activity (compared to 10% last month).

Metalworking industry suppliers are well positioned to assist shops in navigating an economic expansion as the PMI heads toward 50% or higher. Many have built or are expanding or have completed additions to their manufacturing facilities, training centers, research and development centers, and sales and distribution locations. For example, Yaskawa Motoman is building a 185,000-square-foot addition in Miamisburg, Ohio, which will nearly double the size of the company’s production space to meet the growing demand of the automation industry. Yaskawa Motoman is a leading North American robotics manufacturer.

Weldon Solutions, a leading CNC cylindrical grinder and robotic automation systems manufacturer, has completed a 21,000-square-foot expansion of its headquarters in West Manchester Township, Pa. This addition was in response to increased customer demand for CNC grinders and customized industrial automation solutions. The facility now totals 61,000 square feet and will facilitate new product development and additional team growth.

Trade Show subhead

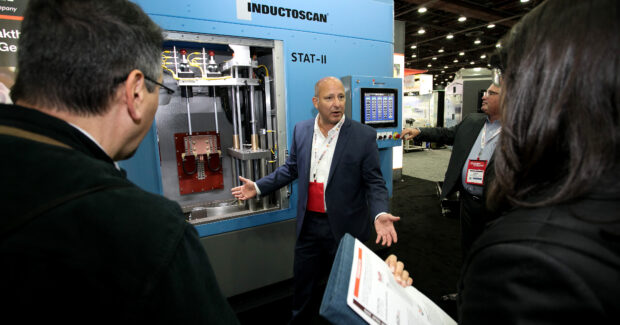

Metalworking companies can experience firsthand the advances and developments in machinery, software and services that emerge from their supplier partners at trade expos and conferences, for example. In addition to plant tours and other events, trade expos and conferences continue to thrive, bouncing back from the interruption that resulted from the pandemic.

Companies that manufacture anything that moves will discover unmatched opportunities at the 2023 Motion + Power Technology Expo (MPT Expo), formerly Gear Expo, being held October 17-19 in Detroit. This issue includes a Product Showcase on MPT Expo. Suppliers from across the supply chain will be represented including gear companies, machine tools suppliers, and electric drive solutions.

These face-to-face networking opportunities, and the steady economic growth in the overall manufacturing economy, inspire metalworkers as they position themselves in the marketplace.

Subscribe to learn the latest in manufacturing.