Ready for the Rebound? This Manufacturer Is

Nuts, screws, and bolts comprise one of metal manufacturing’s most competitive product niches. As it works to gain market share by capitalizing on pandemic-driven supply chain disruptions, this Illinois fastener manufacturer and distributor illustrates the art of decision-making in uncertain times.

Posted: August 13, 2020

BY STEPHANIE JOHNSTON

For all the personal and professional pain it’s caused, the coronavirus crisis is an opportunity. In a recent state-of-the-industry survey by the online manufacturing marketplace Fictiv, 89% of senior executives say their company took a major hit from the pandemic’s economic fallout. Not surprising. However, 97% expect the on-the-fly recalibrations their teams are making to production facilities, supply partnerships, and customer communications to ultimately strengthen their company’s competitive position.

Like them, Optimas Solutions is using the crisis to ask and answer fundamental questions that will enhance its competitiveness. Who are we? What do we want to be? What do we need to do to get there? However, unlike many fabrication and machining companies, the Glenview, Ill., company is answering these questions in an extremely competitive segment of the U.S. metal manufacturing market: the fastener industry.

The company (formerly Anixter OEM Supply-Fasteners) is first and foremost a distributor, but began manufacturing in 1977 at a 139,000-square-foot factory in Wood Dale, Ill. During the first decade of the 21st century, it began buying nut, bolt, and screw manufacturers, acquiring the design licenses necessary to make industrial fasteners such as Tapite, Mortorq Super, and Mathread.

It opened offices overseas and won quality awards from companies like Arctic Cat, Caterpillar, Jaguar Land Rover, La-Z-Boy, and their suppliers. Anixter became Optimas Solutions when the private equity firm American Industrial Partners (AIP) bought Anixter in 2015. Optimas continued acquiring and expanding and joined the digital revolution with a just-in-time inventory-management service called OptiTech VMI Solutions.

Before the pandemic, 1,700 employees generated $800 million annually making and/or distributing 1 billion parts in 150,000 stock-keeping units (SKUs) to 5,000 customers worldwide via 4,000 suppliers. Optimas Solutions’ American operations, with 650 employees and $400 million in annual revenues, aren’t even on Thomas’ list of top 10 U.S. fastener suppliers. In fact, despite a flurry of consolidations during the 1980s, there are still hundreds of competitors just in the U.S.

“It makes for a fascinating competitive landscape,” says President of the Americas Marc Strandquist.

How does a company stand out in that kind of crowd?

Provide Peace of Mind

Manufacturers in all markets are scrambling to harden their vendor network to ensure they’ll be able to deliver orders from new customers who are bringing work back from overseas to domestic suppliers, and Optimas Solutions is no different.

With virtually all steel used to make fasteners coming from Canada, raw material supplies are one challenge Optimas Solutions doesn’t have to overcome. However, that’s an advantage the company’s competitors also enjoy.

In April, 140 key customers shut down because of the pandemic. They’re coming back, with business increasing every month since then, but orders aren’t at pre-pandemic levels. For Strandquist, the first step to winning them all back and gaining new business is to reassure them that Optimas Solutions will be able to quickly meet their needs no matter what.

In early August, responding to customer concerns about supplier stability and lack of visibility in parts availability, the company began rolling out a two-pronged program that addresses these issues. Aimed at both direct customers and supplier partners, the Manufacturing Solutions strategy is a suite of renewed and new initiatives to strengthen vendor relationships, improve production, and speed delivery. Initiatives to enhance vendor relationships that are critical to providing product at the most optimal cost will emphasize collaboration, transparency, and proactively smoothing the flow of parts to users.

Over the coming months, the company will make announcements related to manufacturing, manufacturing consumables, engineering services, e-commerce, and technology-driven platforms such as OptiTech.

“We’ve had to concurrently lead in this moment and get ahead of the curve by investing in our business to address fast-changing marketplace conditions,” says Strandquist. A former fastener plant manager and National Fastener Distributors Association president, Strandquist joined Optimas Solutions in December 2019 after extensive business-development experience with a competitor, the Wurth Group. “We’ll prove we’re a vibrant partner offering stability and trust, traits that are imperative to helping customers through a challenging and uncertain time.”

Managing Change During Change

“We took advantage of the downtime to refine plans that had been in place,” says Strandquist. “We put a lot of time and effort into finishing projects focusing on innovation and technology, and asking ourselves: What’s the new world going to look like and how are we going to adapt to accommodate that new look?”

Strandquist spoke to me from The Abbey, a conference center in Lake Geneva, Wis., where he and 20 key employees were conducting a week-long strategic planning meeting. It was the first time they’d all been physically together since Illinois’ stay-at-home order went into effect on March 21, and the face-to-face contact was empowering.

“It’s so hard to coordinate this kind of interaction and innovation on Zoom meetings and email,” he said. “What’s fun is that in the evenings, when we’re at dinner or having a beer, they’re excited talking about the business. To me, as the leader, there’s nothing more rewarding than seeing people developing their potential and the passion they have for their work.

“We’re not only talking about the next three years, but also asking how are we going to manufacture? A lot of customers aren’t going to see sales reps until next year, so what are we going to do differently?”

Advancing Manufacturing

One improvement project was investing in equipment and technology that will enable Optimus Solutions to rely less on commodity-type parts and more on higher-value products for which there are fewer U.S. competitors.

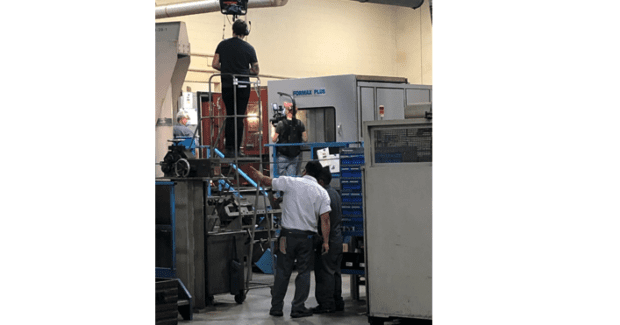

To that end, the company added new cold-forming equipment to the 122 machines already on its Wood Dale factory floor: two Formax Plus 36 and two Formax Plus 56 six-die cold-heading machines for 3/8-inch and ½-inch-diameter steel, respectively. Formax is a brand of National Machinery LLC in Tiffin, Ohio, a global machine tool builder that’s been serving the fastener market since 1874.

“We’re not going to be making simple hex bolts; we’re going to be making more complex parts,” says Strandquist. “For example, internal engine bolts that are roll-fed after heat treatment for hardening; or very-high-tolerance parts that don’t have threads, such as a retaining ring for an engine or a shock absorber ring.”

The equipment investment is being supplemented with new software that provides real-time feedback on production. Over seven months, Optimas implemented Epicor ERP to improve shop floor operations. Big-screen TVs installed throughout the factory show the status of each machine. Supervisors can track output against efficiency goals and operators can make adjustments that have immediate impact.

In addition to increasing profits by lowering costs, the program is enabling the factory to do more with less. Because of the pandemic, the plant is operating with about 75% of its 110 employees.

“Bolts have been around since 1845, so it’s hard to sexy that up; but you can be more efficient,” says Strandquist. “It helps as we try to squeeze out cost and waste to become more cost-competitive.

“We’re unique in the marketplace. While we distribute industrial fasteners and component parts, we also have centrally located cold-form manufacturing to complement and exceed customer needs as a single-source supplier. With an increased emphasis on the customer intimacy, technology-enabled solutions, and speed to market, we think this new strategy is going to deliver huge dividends for all our customer segments.”

Sidebar:

What The Consultants Say About Planning Ahead

“We’re re-energizing existing offerings and rolling out new services that will highlight how much customers are at the core of what we do,” says Marc Strandquist, president of the Americas for Illinois-based fastener manufacturer and distributor Optimas Solutions in announcing a new strategy for maintaining supply chain resilience. “We want customers to know us for manufacturing solutions that support their production, product quality, and financial goals.”

In the first few months of the global coronavirus pandemic, manufacturers threw out the traditional ways of doing things so they could quickly respond to rapidly changing priorities. To keep the momentum going, McKinsey Consulting recommends forming a plan-ahead team to develop action plans for multiple time frames; i.e., this week, two to four weeks from now, one to two months from now, one to two years, and the next normal.

The team should:

- Establish a realistic baseline for this moment in time.

- Develop scenarios for various future versions of your company.

- Broadly outline your company’s direction of travel.

- Determine tactics that are robust regardless of scenario.

- Determine trigger points for taking action.

Don’t waste time trying to perfect anything; the goal is move fast.