Three Considerations When Purchasing Equipment

Here are a few things to consider before shopping that will help you find the equipment and terms best suited to your needs.

Posted: June 28, 2019

When it’s time to purchase equipment for your business, there are a few things to consider before you shop. If you take time to evaluate these three things, you will be better prepared for the search and more likely to find the equipment and terms best suited to your needs.

SHORT OR LONG-TERM NEEDS

When you assess the need to acquire a piece of equipment, consider the timeframe of the need and ongoing capacity utilization. Acquisition options typically include purchase or lease, and understanding your timeframe and capacity needs will help determine which acquisition strategy to use. Why do you need to purchase equipment?

- Continuous, steady growth of the business.

- Acquisition of a new customer or project.

- Obsolescence, replacement or break-down of existing equipment.

If you have continuous, steady business growth and expect that growth to continue, a purchase may be the best option. Additionally, if you are replacing broken down or obsolete machines, new equipment could provide increases in productivity, and capacity. There is no cut and dried answer to the acquisition strategy, but understanding your needs will help you evaluate the best terms for financing or leasing the equipment.

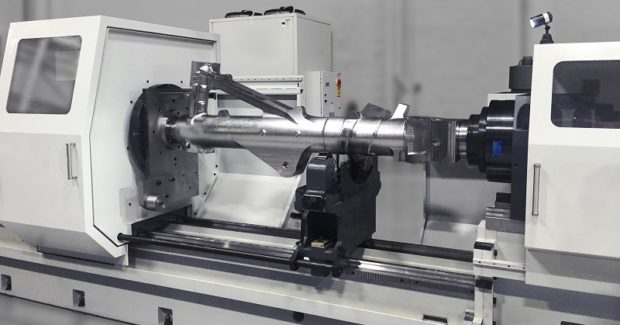

NEW OR USED

Everyone likes shiny new toys (machines) and they often come with the most up-to-date bells and whistles (features), but they can also come with hefty price tags. Depending on the business, the equipment and the needs, sometimes a less expensive, used machine will fit the bill. New machines often provide the following benefits:

- Improved efficiency and energy use.

- Enhanced features that improve productivity and throughput.

- Reduced ongoing maintenance costs.

Used machine benefits include:

- Lower purchase price when compared to a new machine.

- Already accounted for initial depreciation.

- Immediate availability – no need to wait for production time.

As you evaluate equipment options, understanding your business’ needs, challenges and objectives can help determine whether a new or used equipment purchase is the best fit for your company. Choosing the right financing source can provide you with options for either type of purchase.

SHOULD YOU FINANCE OR PAY CASH WHEN BUYING EQUIPMENT FOR BUSINESS?

How do you intend to pay for the equipment? If you don’t have available cash, the choice is fairly simple: finance it. However, even if you have cash available you still might want to consider equipment financing. Using all or most of your available cash to purchase equipment could leave you without funds for operations or emergencies. Additionally, financing essentially allows you to use someone else’s money to fund the acquisition. Granted, you’ll be paying interest, but you’ll also preserve your working capital for additional opportunities and operating expenses. As you evaluate your business needs and equipment financing options, talk with your financial advisor or accountant. They can help you assess the choices, so you can make the best decision for your business.

The post “3 Considerations When Purchasing Equipment” first appeared on www.commercialcreditgroup.com.