How to Upgrade Equipment Without Breaking the Bank

Most companies and banks don’t even consider the possibility of using the equity in existing equipment as collateral to obtain new machines and technology. This can have the effect of reducing overall debt service, potentially reducing monthly payments, and improving cash flow – a win-win all around. Here’s how it works.

Posted: November 30, 2018

Manufacturing is a highly technological industry and, as with any technology-heavy business, there are constant changes, updates and improvements required to keep your company competitive. But keeping up with rapid technology changes can be daunting. If you don’t keep up, you can quickly be left behind and lose your competitive advantage. It’s one thing to assess needs and decide that your shop requires new technology, machines, and/or automation. It’s another thing to pay for that new technology. When it comes to purchasing new equipment for a metalworking facility, most companies simply consider whether they can pay cash for the new machine or technology, or if they need to borrow the capital to make the purchase. If the company does not have the cash on-hand, the owners typically call their banker, who will assess the company’s financial statements, and possibly their personal credit score, to determine if it is a credit worthy risk for a simple purchase loan. Typically, it’s a fairly simple transaction, but one that requires a substantial down payment and additional debt servicing costs.

What most companies and banks don’t even consider is the possibility of using the equity in existing equipment as collateral to obtain new machines and technology. This can have the effect of reducing overall debt service, potentially reducing monthly payments, and improving cash flow. A win-win all around.

EQUIPMENT AS EQUITY

Most manufacturers have several machines that have been acquired over the course of years. Depending on how and when they were acquired, a company will have accumulated varying amounts of equity. This equity can be used as collateral and possibly a down payment for new loans with which to purchase new equipment or technology. The following is an example of how this could be accomplished:

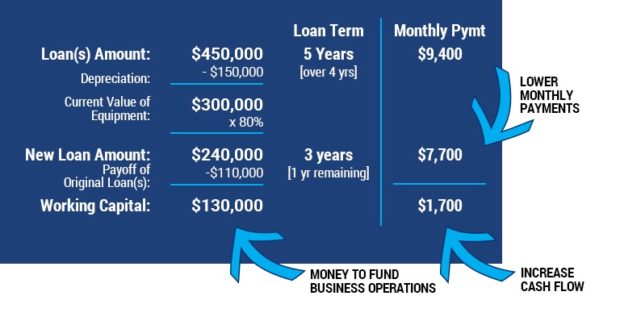

XYZ Manufacturing owns three machines which were purchased four years ago and financed for five years with an original loan amount of $450,000. Monthly payments total $9,400 and payoff amount is $110,000. With four years of depreciation, the current value of the machines is $300,000. These can be refinanced with a loan equivalent to 80 percent of their value, or $240,000. With a term of 36 months, the monthly payment would be $7,700. After paying off the remaining $110,000 principal on the original three machines, the company has $130,000 in working capital to purchase additional equipment or technology. Additionally, the monthly payments drop from $9,400 to $7,700, freeing up an additional $1,700 in monthly cash flow!

If reducing monthly cash flow isn’t a primary concern, the company could include the financing of new machines with the refinancing of the existing machines or reduce the 36-month term in the example above to a shorter term.

WORKING CAPITAL NEEDS

One of the biggest benefits to the above scenario is the $130,000 in working capital. That working capital can be used as a down payment on the purchase of the new technology discussed above or for a number of other needs including:

- Raw material

- Automation equipment

- Tooling and fixturing

- Building improvements

- And more

The key to accomplishing this is working with a lender that understands the manufacturing industry and the equipment used in the business. Most banks don’t have the equipment expertise to even begin to construct the financial solution outlined above, nor do they take the time and effort to evaluate the business needs and value of the equipment. Knowing that there are options aside from simple purchase loans is a key step for businesses as they explore financial solutions.

PROTECTING THE EQUIPMENT EQUITY

There are many factors at play when assessing the value of used equipment: age, options, accessories, hours of service, and of course maintenance. A company has a great deal of control over maintenance, especially when it comes to preventive or scheduled maintenance. To ensure that there is equity in manufacturing equipment, it’s important that the equipment be maintained properly. Well-maintained equipment has a longer usable life and retains its value longer. A longer usable life is important to the business for enhanced production capacity, but can also have additional leverage when using the equipment to help fund business operations. An equipment finance company that specializes in asset-backed loans will evaluate equipment to help assess the borrowing power of the company. The higher the equipment value and the greater the equity in the equipment, the greater the borrowing power. The greater the borrowing power, the more flexibility the company has when adding new technology and equipment.

KNOW YOUR OPTIONS

Knowing that there are options beyond simple purchase loans gives companies a leg up when they search for financing. Understanding that equipment equity can be used to structure a variety of financial solutions, including refinancing, debt consolidation, and working capital loans, provides companies with options that don’t necessarily add to the existing debt load or debt servicing. The key is to work with an industry-savvy equipment lender to ensure equipment upgrades or fleet additions won’t break the bank.