Metal Fabrication: The State of the Industry

Shop owners and decision makers are feeling more comfortable with the economic climate and are more willing to make capital investments in new machinery that adds capacity to their operations. Here are some insights into the equipment they will need.

Posted: December 11, 2017

As we enter the New Year, the state of the metal fabrication business in North America is stable and increasing. Based on growing equipment sales and the large number of shops that are interested in purchasing new lasers, tube lasers, punching equipment and press brakes, business owners and decision makers are feeling more comfortable with the economic climate and are more willing to make capital investments in new machinery that adds capacity to their operations. Since job shops that are active in more than one market sector make up a significant portion of these users, it is difficult to accurately pinpoint a distinct industrial market that is leading in terms of increased activity.

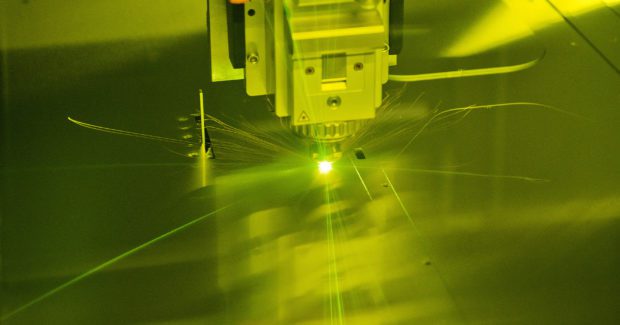

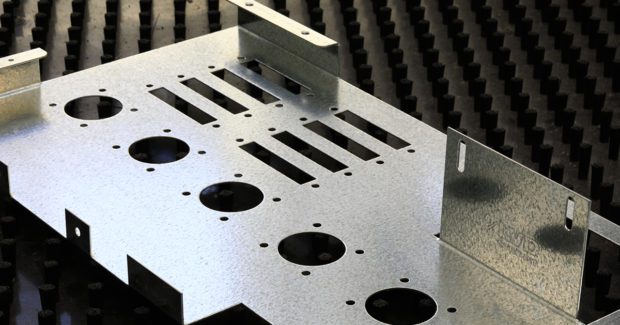

There are strong opportunities for laser cutting machinery because of its fast cutting speeds, versatility and ease of use. This interest should naturally translate into more activity for press brakes, as bending is a secondary operation to cutting. The high speed of fiber laser technology is fueling the need for faster press brakes and automation that can maintain capacity and keep pace with the productivity of this laser cutting process. With competition continually demanding ever smaller batch sizes, shorter lead times, quicker turns and better material utilization, look for Industry 4.0 automation and data exchange to gain increasing importance, even with small shops.

At the heart of Industry 4.0 is the machine controller with integrated software that connects machines and processes. Look for growing emphasis on machine tools that are equipped with a touch-screen controller linked to a central database where all production-relevant information (“Big Data”) is stored, including part import over work preparation/engineering to final production data, production history, workload and KPI/key performance indicators. This connection allows seamless digital transfer of production data back and forth from a shop’s management systems to the factory floor – a digital, paperless production flow that streamlines the fabrication process. Handling communication to management, planning, production, quotation, costing, and other external software modules via a standardized open interface creates a more dynamic manufacturing environment that can improve quality, reliability, throughput and reduce production costs.

As more fabricators see the value of this digital transformation, no matter their size or state, the mystery of Industry 4.0 will fade and their need for investment will grow. This is one of the reasons a potential change in the Section 179 Tax Deduction could be a significant benefit for many small to mid-sized shops. A tax savings offers a tremendous incentive for them to buy capital equipment: many small shops can write off the entire cost of a machine up to $510,000 (plus potentially 50 percent bonus depreciation) on their 2017 tax return. Depending on their tax situation, this can save 20 percent to 30 percent of the equipment cost in tax savings in the first year. A recently proposed change for 2018 will increase the Section 179 Deduction to $5 million, with a phase out beginning after $20 million in equipment purchases. Additionally, the Bonus Depreciation is proposed to increase to 100 percent for purchases effective September 27, 2017, which means this could be retroactive to orders for machine deliveries in the fourth quarter of 2017.

If this tax change provision does go into effect, this will open many shops up for larger investment in capital equipment. With such an incentive beginning in 2018 (and potentially retroactive), expect machine orders to finish strong at the end of 2017 and continue into 2018. Shops that are considering increasing their capacity or upgrading their equipment should take advantage of favorable tax laws and order equipment sooner, rather than later, to ensure machine availability. This doesn’t start with buying a particular machine or service. It starts with finding the right supplier: one that listens and understands all of the challenges they face – multiple tooling setups, addressing short run requirements, bottlenecks in secondary operations, lack of skilled labor, etc. – that works with them to identify the proper technology to meet their needs.