Global CAM Market Remains Strong

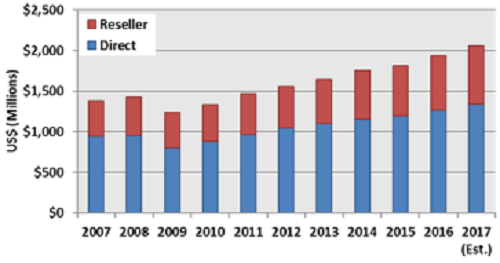

CIMdata projects that the CAM software market will increase by 6.4 percent to $2.1 billion in 2017.

Posted: June 7, 2017

CIMdata, Inc. (Ann Arbor, MI), a leading global PLM strategic management consulting and research firm, has released their 2017 CAM Market Analysis Report (MAR), the 26th annual study of the global Computer-Aided Machining (CAM) market. They estimate that, based on end-user payments, the worldwide CAM software and related services market grew by 6.9 percent in calendar year 2016. The estimated end-user payments grew from $1.81 billion in 2015 to $1.94 billion in 2016.

“The CAM results were solid in 2016, with few of the currency effects that impacted the results reported last year,” said Stan Przybylinski, their vice president of research. “Even in the face of slower machine tool consumption, shops still continue to invest in new CAM software.” CIMdata projects that in 2017 growth in manufacturing will continue and end-user payments for CAM software will increase by 6.4 percent to $2.06 billion.

Since 2002, the CAM software market has shown modest but steady growth as global economies generally improved. There has been worldwide growth in the sale of machine tools and manufacturing output; greater emphasis has been placed on the efficient operation of machine tools as manufacturing firms have strengthened their competitive positions; and the overall Product Lifecycle Management (PLM) market, of which CAM software is a component, has continued on a strong growth path during this period. CAM software purchases are related to all of these factors-particularly machine tool sales.

“The CAM market had solid growth in 2016, but it will be interesting to watch the adoption of additive manufacturing (AM) technology into the mainstream manufacturing process,” noted Mike Fry, their director of manufacturing systems engineering practice. “There will be significant changes in how AM is incorporated into the PLM digital thread and its effects on the market. We are seeing the emergence of specialized functionality for AM in combination with subtractive manufacturing, from the software providers and machine tool manufactures. We are also seeing substantial interest in the adoption of the Internet of Things (IoT) and Industry 4.0 across the manufacturing value chain. This, added with predictive analytics, should accelerate the manufacturing market in the near term.”

The size and growth of the CAM software and related services market shows that approximately one-third of the end-user payments are reseller revenues and approximately two-thirds of the revenues are payments made directly to software suppliers. The 2017 version of the CAM MAR is a 150-page report containing 22 charts and 39 tables of data detailing the worldwide CAM market along a number of dimensions. It also includes a discussion of trends in the CAM industry and updates on the top CAM solution providers. To purchase the 2017 CIMdata CAM Market Analysis Report, please click here.