NAFTA Renegotiation: Are You Prepared?

The agenda is being set and manufacturers have an opportunity to get the issues that matter to them on the table. Now is the time to consider how NAFTA benefits or harms your business. Analyze what might happen if those benefits or burdens are changed or eliminated, monitor developments and participate in the process. To get started, here are some of the significant issues likely to be on the agenda, and some ways to ensure that your business’ interests are represented at the negotiating table.

Posted: April 17, 2017

President Trump has announced his intent to renegotiate the North American Free Trade Agreement (NAFTA). If you do business with or in Canada or Mexico, chances are the negotiation process and outcome will have an impact on your bottom line. Let’s examine the economic relationship between the United States and our NAFTA partners, discuss the process and timing for renegotiation, highlight significant issues likely to be on the agenda, and suggest ways to ensure that your business’ interests are represented at the negotiating table.

BENEFITS OF NAFTA

Negotiated 25 years ago, NAFTA was the most comprehensive free trade agreement at the time. With a few exceptions, tariffs on goods produced and traded within North America were reduced to zero. Barriers to investment were eliminated and service providers were generally free to operate throughout the North American market. The resulting economic integration of the North American economy has been extensive. Trilateral trade between the NAFTA partners has more than tripled since NAFTA took effect. By 2011, trilateral trade had surpassed the $1 trillion threshold. Annual trade between the U.S. and Mexico in automobiles and auto parts alone accounts for over $120 billion; trade in electrical and electronics equipment accounts for another $140 billion. For the past several years, Canada has been the leading market for U.S. exports, while Mexico has ranked second. In 2016, these two countries accounted for 34 percent of total U.S. exports. Canada and Mexico also are the second and third largest suppliers of U.S. imports, accounting for 26 percent of total U.S. imports in 2016.

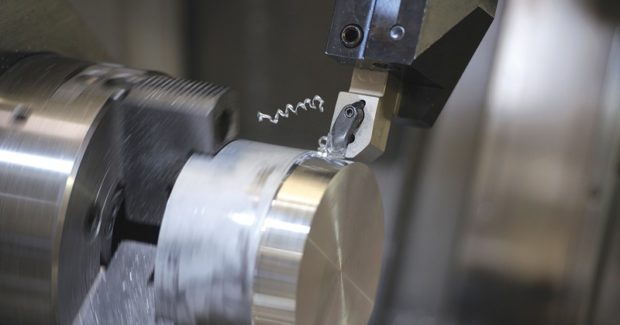

With respect to trade in goods, the U.S. trade deficit with Canada in 2016 was $11 billion: the U.S. exported $267 billion and imported $278 billion. The U.S. trade deficit with Mexico was $63 billion: the U.S. exported $231 billion and imported $294 billion. The largest categories of traded goods include automobiles and parts, petroleum products, and industrial machinery and equipment. These statistics reflect the extensive economic integration between the United States, Mexico and Canada. The Administration argues that NAFTA renegotiation will increase the competitiveness of American businesses and help bring back manufacturing jobs. However, renegotiation plans also have the potential to undermine the economic and production advantages of duty-free cross-border trade and disrupt well-established integrated supply chains.

PROCESS AND TIMING

The U.S. law known as Trade Promotion Authority (TPA, otherwise known as “fast track” because it provides for an up-or-down vote in Congress without amendments) sets forth the procedures that the President must follow in renegotiating NAFTA. The President must notify and consult with Congress before initiating negotiations. Formal written notice of intent to begin negotiations starts a 90-day period during which the Administration will solicit input from the business community and other interested parties. The Administration also is required to publish a list of specific negotiating objectives before initiating negotiations.

The Administration recently began its consultation process, and it is possible that the President could formally notify Congress before the end of April. If so, negotiations could begin as early as July. However, with additional consultation, notification and reporting requirements during the course of the negotiations, as well as post-agreement review by certain government agencies and Congress, a new, revised NAFTA is not likely before mid-2018. Companies should not be complacent, however. Now is the time to analyze and plan for possible impact on your business.

ISSUES ON THE AGENDA

For manufacturers doing business with or in Canada or Mexico, or those experiencing unwelcome competition from those countries, the negotiating agenda will present significant opportunities, but also challenges:

Eliminating Red Tape

On the positive side, there are at least a few agenda items that would actually improve and facilitate cross-border trade and bring down costs as well. Administration officials and their Canadian and Mexican counterparts are likely to find common ground when considering changes in import and export processes that reduce bureaucratic delays and “red tape.” Simplifying and harmonizing Customs paperwork and processes, encouraging regulatory cooperation as a way to improve transparency and regulatory compatibility, and improving border infrastructure have all been mentioned as possible agenda items. Given the magnitude and frequency of U.S. trade with NAFTA partners, any agreement on modernization, simplification and harmonization of customs procedures and processes is likely to result in significant cost savings, particularly for small and medium-sized businesses.

Rules of Origin

With respect to significant challenges, several of the likely agenda items will impact a wide range of businesses. The first, NAFTA rules of origin, describe the complex circumstances under which goods can be deemed to have NAFTA origin. NAFTA origin goods qualify for duty-free treatment when sold between NAFTA partners. The most straightforward situation in terms of qualifying for duty-free treatment is where the goods are wholly produced in the NAFTA region. A more complex situation, but likely more common with respect to metal products, involves finished or semi-finished goods that contain non-NAFTA inputs. In this situation, whether the finished or semi-finished goods can be deemed to have NAFTA origin will depend on their final regional value content and/or a change in tariff classification as a result of the production process.

Administration officials are proposing to “tighten” the rules of origin. In essence, this means raising the North American content requirement for goods to qualify for duty-free treatment. Parts and inputs sold between the NAFTA partners that previously qualified for duty-free treatment would now be subject to tariffs. While U.S. import duties generally are relatively minimal, the same cannot be said for Mexican and Canadian import duties. In particular, U.S. exports to Mexico could be hit with significant Mexican import duties. Given the extensive reliance on integrated cross-border supply chains, the additional duties could drive manufacturers to rethink their sourcing strategies and consider suppliers outside the NAFTA region.

Government Procurement

The second agenda item that will present significant challenges for U.S. companies relates to government procurement. President Trump has made “Buy American, Hire American” a top priority for his Administration. In general, Buy American laws offer preferential treatment for U.S. products in government procurement opportunities. In the context of NAFTA renegotiation, Administration officials are considering eliminating the Buy American waiver for Canada and Mexico provided under NAFTA. That waiver provision is intended to put Canadian and Mexican goods on equal footing with U.S. goods. If the waiver is eliminated, Canada and Mexico likely will terminate their related waiver provisions applicable to U.S. goods. Bidding on cross-border government procurement contracts will be significantly more difficult and manufacturers in all three countries could be significantly affected.

Cross Border Trucking

A third possible agenda item is specific to Mexico and relates to cross-border trucking. Under NAFTA motor carrier access provisions, all three countries’ highways are intended to be fully accessible to vehicles of trucking companies based in any NAFTA nation. American trucking companies have been able to apply and operate long-haul in Mexico through NAFTA since 2007. The United States, citing safety concerns, initially refused to permit Mexican trucking companies to apply and operate in the United States. After litigation (which Mexico won), retaliation (because the U.S. refused to comply), and a pilot program (2011), the United States finally granted Mexican carriers and drivers U.S. operating authority in 2015. During NAFTA renegotiation, certain stakeholders will likely push to revise NAFTA’s trucking provisions. Any rollback on trucking rights will be disruptive for companies with cross-border supply chains, particularly along the southern U.S. border.

THE ELEPHANT IN THE ROOM

During the campaign, President Trump called for taxes on imports from Mexico as a means to address the trade deficit and revive American manufacturing and jobs. While the President continues to endorse border taxes, including the so-called border adjustment tax (“BAT”), it is unlikely the tax issues will be formally included on the NAFTA renegotiation agenda. That said, this issue is worth keeping on your radar. The basic notion is that U.S. exports would be exempt from taxation, but imports would not. While there is significant opposition to the BAT from import-oriented industries like retailers and refiners, the import tax is likely to remain an integral part of any tax reform package moving through Congress. Consider running the numbers to see how the BAT affects your business, and have a plan to respond.

WHAT SHOULD YOU BE DOING?

With the exception of border taxes, the issues mentioned above are just a few of the possible items on the NAFTA renegotiation agenda. Issues related to e-commerce and cross border transfer of information also will likely be on the agenda, as well as certain intellectual property rights issues. The point is that the agenda is still being set, which means you have an opportunity to get issues that matter to you on the table. Consider how NAFTA benefits your business or harms your business. Analyze what might happen if those NAFTA benefits or burdens are changed or eliminated.

The good news is that NAFTA renegotiation is in the early stages and the actual negotiations, once initiated, with take some time. But don’t be complacent. Monitor developments and participate in the process. Respond to the Administration’s solicitation of input from the business community. And engage with government officials to ensure negotiating objectives reflect your interests. Renegotiation of NAFTA will not happen overnight, but act now to protect your interests.

The co-author of this article is Stacy J. Ettinger, a partner in the Washington, DC, office of K&L Gates, 1601 K Street NW # 1, Washington, DC 20006, 202-778-9072, Fax: 202-778-9100, [email protected], www.klgates.com.