Determining a Machine’s True Value

In addition to the purchase price, many other costs factor into the machine’s true cost to determine the long-term cost of ownership that decides whether investing in high-performance machining centers is a better business solution than a lower-cost option.

Posted: November 7, 2015

Manufacturers typically purchase new equipment to obtain higher capacity or improved methods and technologies for production. With a significant capital investment, the purchase price is always carefully examined to determine return on investment (ROI) for these new machines, but it can be challenging for many shops to calculate the true ROI. Most manufacturers focus only on equipment price when making calculations and neglect to evaluate the total life cycle cost or anticipated performance of the equipment. This oversight can often dwarf the original purchase price.

FACTORS THAT IMPACT ROI

The acquisition, operating, maintenance and decommission costs all contribute to a machine’s true ROI calculation. Acquisition costs include the purchase price, installation and training. Post-sale service, supplier reputation, warranty and support services offered are other important factors to consider. For example, a vendor’s availability to conduct operations and maintenance training and improve employee competency is something that can prevent productivity loss.

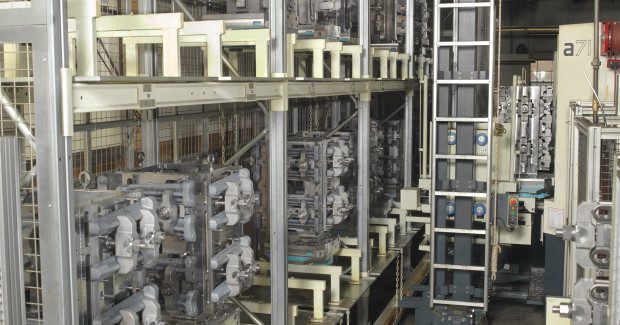

When it comes to operating costs, manufacturers must determine the impact that new equipment can have on productivity. A high-performance machining center typically has a design and construction that improve these key aspects of operation:

- Cycle time. The ability to prepare multiple workpieces in a single setup or completing more parts per shift over commodity machines affects cycle time. Producing more parts and saving labor automatically lower the actual cost per part, overcoming the original purchase price.

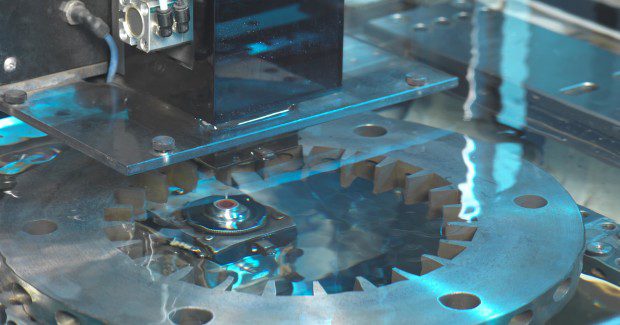

- Tool life. High-performance machining centers have been shown to deliver improved tool life and performance, thanks to a rigid construction that means fewer passes with the tool are needed, reducing processing times. Many of our customers report significant improvements in tool life which enable them to reduce operator intervention and cut part costs.

- Part quality. The accuracy and precision of a high-performance machine affect part quality. Even parts with complex geometries come off the machines with tight tolerances and high-quality surface finishes, reducing inspection time and eliminating manual finishing operations such that manufacturers can reduce operating cost and take on more orders.

- Reliability. Special programming features mean that operators do not have to continually stand at the machine to recall programs, and the equipment can run uninterrupted or unattended to reliably and consistently produce parts.

Maintenance can also factor into ROI calculations. Once production starts, unscheduled downtime can quickly erode any saving on purchase price. Similarly, when purchasing equipment, manufacturers also need to consider decommission costs. The residual value of the machine should be accounted for in the actual ROI.

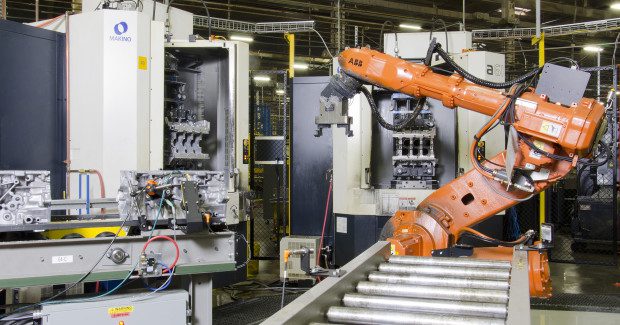

HOW AUTOMATION CAN HELP IMPROVE ROI

Many manufacturers don’t take into consideration the fact that automation can increase machine utilization by as much as 95 percent, because machines are kept in cycle. The minute one part is completed, the next part goes into production, sometimes running 24/7. Faster part turnaround results from eliminating direct setups on the machine. Higher throughput helps the business become more profitable. Automation also allows for flexible production quantities and reduced lead-times. It also brings higher quality parts with less scrap and lower part costs.

IMPACT OF LEASING VS. BUYING

After evaluating cost per part from acquisition, operating, maintenance and automation, a manufacturer should next determine the best way to pay for the equipment. This transaction can be done with cash or through financing. Paying cash enables a business to own the equipment as soon as the transaction is completed, but it also reduces the company’s cash flow for other investments.

Financing enables a company to better match monthly cash flow being generated from the equipment to the obligation of the monthly payment due under the financing vehicle. Making payments can be handled through a traditional loan or by leasing the equipment. When buying an asset, it is critical to consider the long-term costs of ownership, such as maintenance and downtime that can mount when a company holds onto an asset over time. Looking toward the future can help determine the financing route that works best for the operation.

HIGH-PERFORMANCE CAN BE BETTER SOLUTION

To be competitive, manufacturers certainly want to take advantage of the most advanced technology available. In addition to the purchase price, many other costs factor into the machine’s true cost. When considering these expenses, long-term cost of ownership can be better determined. Investing in high-performance machining centers instead of the lower-cost option can ultimately be the better solution for the business.