Fair Market Value or $1 Buyout Lease?

For small to mid-sized job shops that are looking to acquire equipment, financing provides a way for them to preserve their capital, in addition to numerous other benefits. Here are five questions they must answer to determine the appropriate leasing option for their operation.

Posted: September 2, 2015

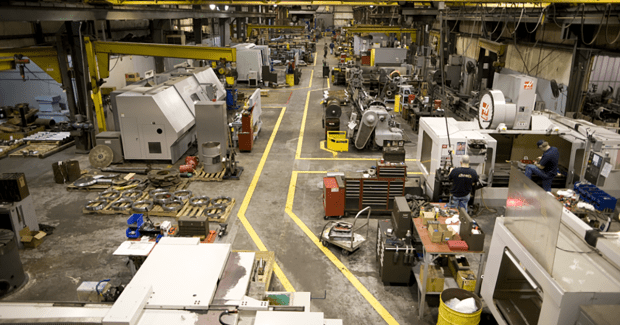

One of the biggest challenges small to mid-sized job shops can face is the lack of capital to grow at a time when they need loans to hire more workers, buy new equipment and aggressively market themselves. Smart business owners and managers know that preserving capital is an important financial goal. Particularly in the case of a small or start-up business that doesn’t have the access to capital that larger or better established businesses do. When looking to preserve or access capital, equipment financing is an attractive option that offers these and numerous other benefits when acquiring equipment. With leasing, knowing the factors that go into deciding whether to enter into a fair market value (FMV) lease or $1 buyout lease will enable a shop to make the right financing choice for the equipment they need to operate their business.

It’s useful to start by having an understanding of the definitions of an FMV and a $1 buyout lease. An FMV lease is an operating lease to use equipment, while a $1 buyout lease is a capital lease to own equipment, which essentially acts as a loan. With an FMV lease the equipment is used for a certain period and, typically, used at a lower cost than if the equipment were purchased outright or with borrowed capital. The reason for this is that the used equipment has a residual value at the end of the lease which the financing company can expect to realize through the sale or re-lease of the asset. With an FMV lease, a shop does not pay for the full cost of the equipment. Should the shop decide at lease end that they’d like to continue to use the equipment, they may have the option to buy the equipment at a negotiated fair market rate or use it at a reduced rental, depending on the lease terms.

There are multiple reasons to use an FMV lease. The business can realize significant benefits from the following:

- Accurate budget planning.

- Reduced cost of use of the equipment.

- Elimination of equipment obsolescence.

- Outsourced cost and responsibility of equipment management and disposal.

- Bundled services, such as a lease tracking system to alert the user to the end of the lease in order to plan for replacement or return of the equipment, and maintenance.

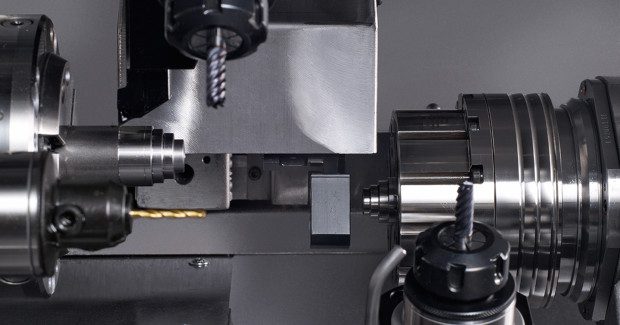

Long life equipment types such as machine tools and other shop floor equipment are suitable for FMV leases since they typically maintain relatively higher residual values. It is also more economically beneficial to enter into an FMV lease for machinery used in projects, common in construction, and for seasonal needs, such as in agriculture. Some shorter useful life equipment types, such as technology and office equipment, are also appropriate for FMV leases since they help end users avoid owning obsolete equipment at the end.

$1 buyout leases are often entered into when obtaining financing through equipment manufacturers. These are frequently offered as a sales incentive. Since end users typically prefer to hold onto their capital, if their objective is to own the equipment in the future then a $1 buyout lease offers 100 percent financing and no down payment which enables them to preserve cash. A $1 buyout lease also gives ownership of the equipment to the end user for tax purposes so bonus depreciation and interest expenses can be claimed.

Often the choice between an FMV lease and a $1 buyout lease depends on the predisposition of the end-user company. To help make an objective business case, consider the following five key questions that should be considered in an FMV or $1 buyout lease decision:

- How long will the shop need to use the equipment? Generally speaking, if the length of time the machinery is expected to be used is short term (which usually means 36 months or less), an FMV lease is likely the preferable option. Equipment expected to be used longer relative to its useful life or that the shop knows they will want to keep at the end of the term is appropriate for a $1 buyout lease.

2. How soon will the equipment become obsolete in the future? Most machinery will become obsolete at some point, some faster than others. The sooner it is expected to become outdated, the better suited it is for an FMV lease so the shop doesn’t get saddled with old technology and can upgrade with new equipment that can give their business a competitive edge.

3. Does the shop have the resources to manage assets throughout their lifecycle? Equipment management is a function that requires resources and expertise that are beyond the scope of most businesses. Selling or disposing of the asset, maintenance, repair and other aspects of asset management become the end-user’s responsibility at the end of a $1 buyout lease. With an FMV lease, the shop outsources the asset management function to the equipment leasing company so they can focus on their core business.

4. Does the shop anticipate the need for additional equipment? If this business is planning for growth, the shop will want their machinery to be able to scale. An FMV lease will enable them to get the right type and amount of equipment their business needs in the future, and not be forced to mix and match newer with older assets.

5. Will the equipment be used for a new venture? When embarking on an untested business venture, there may be uncertainty of when or if it will be successful. An FMV lease will enable the shop to mitigate the risks of uncertainty and hedge against ending up owning a piece of machinery they may not need in the future.

Whether a shop chooses an FMV lease or a $1 buyout lease, the most important thing to keep in mind is that both will enable the business to enjoy benefits they can’t attain when purchasing equipment with cash. For informational resources on equipment leasing and financing, including a digital toolkit, videos and a provider directory, please click here.