Big Data in Manufacturing: A Compass for Growth

Big Data analytics is taking over manufacturing and providing a totally new dimension to the value of research and trend analysis. Instead of only reporting past activities, data now predicts future events, foresees risk and helps shops build and deliver not only better products, but a richer overall experience for their customers.

Posted: July 31, 2015

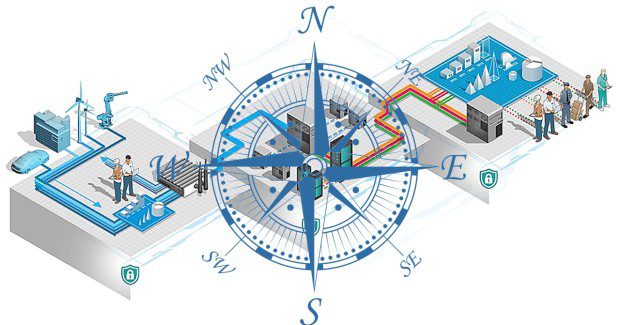

Data has long been the essential lifeblood of manufacturing, driving efficiency improvements, reductions in waste, and incremental profit gains. But today, a new breed of Big Data analytics is taking over manufacturing and providing a totally new dimension to the value of research and trend analysis. Now data is no longer being used for reporting past activities; it’s being used to help manufacturers predict future events, foresee risk, understand their extended value chain and enhance the customer experience they deliver. Data is all grown up, with new multi-dimensional capabilities and broader horizons. It’s like a compass, pointing the way for manufacturing growth.

Where is all the data coming from? Manufacturers today have more resources for data capture and tracking than ever before. The overabundance of data can be intimidating and cause job shops and contract manufacturers to struggle to understand how to use the data and how to harness its power. Data can come from external sources, internal sources or be generated by machine-to-machine interaction. Together, these sources can provide shops with the information they need about their customers, products, processes, people and equipment:

- External sources — Manufacturers can turn to external sources, such as user groups, social media, focus groups, or surveys to build customer data. Third-party surveys, portals, and call centers add an impartial layer to the data collection that is often less threatening to the customer. The promise of anonymity can also generate higher response rates. This fact finding can be used to build accurate profiles of customers and prospects, including subjective or “soft” characteristics, like color and design preferences, common buying triggers or evaluation criteria.

- Internal sources — Manufacturers can also turn to their own systems for data capture and analysis. A modern, integrated ERP system can provide data on products, processes, and people at all levels and departments in the organization. Data collected through an ERP system offers benefits, such as real-time reporting with up-to-the-minute accuracy, a common database that provides one version of the truth, the ability to drill down into details for historical depth and relational data with context and relevance.

- Machine-to-machine — Smart sensors and the Internet of Things (IoT) can now collect data directly from machines and equipment and send it on to an ERP system, EAM system or other enterprise application. Built-in, low cost sensors can detect a wide range of attributes, including location, weight, temperature, vibration, flow rate, humidity and balance. These conditions can then be monitored in order to identify and predict performance issues that require service, repair or replacement. This allows manufacturers to get an early warning of impending issues, and hopefully intervene before there’s a catastrophic interruption to processes and performance.

What can job shops and contract manufacturers do with all that data? In this new paradigm of manufacturing data, the focus is no longer primarily on reporting on past events; data today is also being used to predict trends and anticipate needs. Big Data acts as the gateway to the future. Shops certainly understand the value of predictive abilities. Anticipating consumer trends, stocking necessary inventory, and maintaining adequate resources to meet customer orders have been high priorities for manufactures for decades.

As speed of delivery and just-in-time inventory strategies gained importance, the ability to accurately forecast needs also grew. Manufacturers learned — sometimes the hard way — the importance of choosing the right influencing factors or the right combination of factors. When attempting to predict the future, one data source is seldom sufficient.

Today, predictive analytics has become a valuable science and tool for all shops. It turns data collected from numerous sources into a blueprint for future actions. Modern business intelligence solutions now have the ability to project trends with a high degree of accuracy. As in any data initiative, though, the output is only as good as the input. Manufacturers must take care to choose reliable data sources and to continue to refine which influencing factors provide the best signposts for future activities.

Predictive capabilities offer many benefits to manufacturers, including staffing readiness, better plan just-in-time inventory levels of raw materials and provide an accurate understanding of the product lifecycle. Anticipating consumer trends also provides a much-needed competitive head start, allowing the timely manufacturer to be first to market with a product innovation or first to introduce a breakthrough concept to an emerging niche market. Companies that are early arrivers often maintain valuable ownership of the market.

Successful product innovation largely relies on an accurate reading of the market’s preferences and needs. Design engineers need to understand the consumer’s pains in order to determine the potential value of new products and help prioritize allocation of R&D dollars. Big Data makes this possible.

How can Big Data fuel growth? How can Big Data provide significant return on investment (ROI) and lead to manufacturing growth? These are the questions manufacturers must answer, if they want to take full advantage of Big Data’s potential. Big data acts as a compass — it provides a guide, but it’s not magically going to start generating greater sales and more customers.

Collecting data — whether from machine tools through the Internet of Things (IoT) or from customers through online portals — is not the end. That data must be translated into action. This is the step that requires careful attention to details and a thorough understanding of the relevance of the data. This is also where many manufacturers fall short in their Big Data initiatives. But with careful analysis, data can be used to identify, analyze, and foster growth opportunities by helping manufacturers identify new geographic regions to target, expand into niche/micro markets, tap into a customer base, foster customer intimacy, innovate, improve product lifecycle, increase value-add and improve profit margins.

It’s time for Big Data. It’s becoming clear that shops need to embrace Big Data in order to remain competitive. Manufacturers that make the most of the customer, product, and equipment data they capture, stand to improve their ability to innovate, please their customers, and bring more profitable products and services to market more quickly.