Putting Your Head in the Sand is a Bad Idea

The Department of Justice and Securities and Exchange Commission are ramping up enforcement of the Foreign Corrupt Practices Act to the point that it is imperative that officers, directors and relevant employees of every manufacturer sit up, take notice, and become informed.

Posted: April 15, 2015

One cannot take comfort in the fact that a person must act “corruptly” to violate the FCPA. Conscious disregard, willful blindness, and deliberate ignorance are enough to meet the “corrupt” requirement. FCPA liability cannot be avoided by “not asking too many questions” or by “looking the other way.” Instead, companies have a duty to inquire further upon discovering facts that would indicate to a reasonable person the possibility of illegal payments. When dealing with a distributor, consultant or sales representative, due diligence should be conducted prior to commencing a relationship, and periodically throughout the relationship. All agents, distributors or consultants should make written representations regarding FCPA compliance. Ensure that compensation of agents and consultants is reasonable in light of what is typical, and the nature of the services rendered. Be suspicious of unreasonably large commissions paid to representatives or consultants, or unreasonably large “spreads” between the price products are sold to a distributor and the price the distributor is paid by the end customer. Obtain (and exercise) the right to audit the books and records of agents, sales representatives and distributors.

The FCPA’s definition of what is an unlawful bribe under the FCPA is broad. Of course, a payment of money – a classic bribe – violates the FCPA. Less obvious is the fact that charitable contributions, employment of family members, travel and entertainment, and even free or discounted medical services to a foreign official or family members will trigger a violation if it can be shown that these expenses are incurred or paid directly or indirectly at the request of or to benefit a foreign official in order to obtain or retain business. A payment in order to obtain favorable tax treatment or regulatory advantages also violates the law. The Bank of New York Mellon Corp. just revealed early this year that it may face FCPA charges over internships it allegedly gave to relatives of sovereign wealth fund officials, following an investigation by the SEC. The SEC also previously investigated whether JPMorgan Chase & Co. hired the children of prominent Chinese government officials and business leaders in a bid to obtain business, and Goldman Sachs Group Inc. has also admitted that regulators are investigating whether its hiring practices violate the FCPA.

As another example, several months ago, two individuals who were employed by FLIR Systems Inc. (Wilsonville, OR) – Stephen Timms and Yasser Ramahi – agreed to settle charges that they violated the FCPA by taking Saudi Arabian governmental officials on a “world tour” to help secure business for the company. The prosecutors claimed that the “world tour” and some other expensive gifts were given in exchange for a multi-million dollar contract to provide thermal binoculars to the Saudi government in November 2008. In this instance, the individuals’ settlement included only financial penalties and not jail time – however, even without jail time, one can imagine that this incident severely negatively impacted the lives of these men.

The FCPA’s definition of “foreign official” is also broad. An employee of a foreign government is obviously a “foreign official” under the FCPA. However, “foreign official” can also mean any officer or employee of a government-owned entity, even if the government-owned entity is operated like any privately-owned commercial enterprise.

A U.S. company participating in a foreign joint venture faces potential prosecution in the event of violation by the joint venture of the FCPA, so must ensure that effective compliance programs and internal controls are in place at the joint venture. Companies must also be cognizant of, and protect against, FCPA violations in subsidiaries and affiliates.

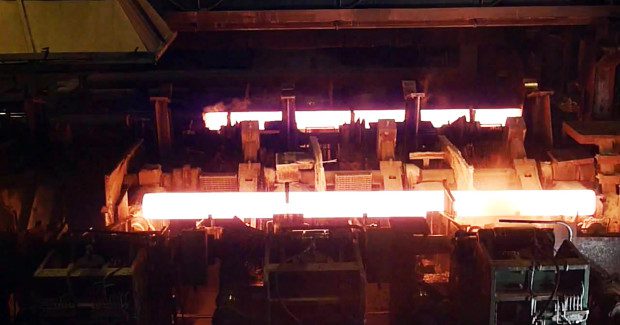

While self-reporting FCPA violations is looked upon favorably by regulators, even self-reporters in the current environment can face significant penalties. Tenaris S.A. (Luxembourg City, Luxembourg), a global manufacturer of steel pipes, paid a total of $8.9 million in fines in 2011 to settle FCPA charges by the SEC and DOJ. It was alleged that Tenaris bribed Uzbekistan government officials during a bidding process to supply pipelines for transporting oil and nature gas. In this case, Tenaris itself found the FCPA violations after an internal review of its worldwide operations, and notified the SEC of its findings. As a result of its cooperation, it was permitted to enter into a Deferred Prosecution Agreement with the SEC. It is likely that Tenaris would have suffered greater fines and penalties if it had not self-reported and agreed to the Deferred Prosecution Agreement. But clearly it would have been better if Tenaris had prevented the illegal behavior. In explaining the size of the penalty imposed on Alstom, discussed above, the DOJ noted (among other factors) Alstom’s failure to voluntarily disclose the conduct even though it was aware of related misconduct at a U.S. subsidiary, and Alstom’s refusal to fully cooperate with the DOJ’s investigation for several years.

It is also important to note that the anti-bribery provisions apply to private as well as public companies, small as well as large. And this is not theoretical; the SEC and DOJ have prosecuted both relatively small public companies (with revenues well below $1 billion) and privately owned companies for FCPA violations. As a recent example of the latter, in early January, 2014, the DOJ unsealed criminal complaints against two former co-CEOs of PetroTiger, Ltd., a privately-held British Virgin Islands oil and gas services company with offices in New Jersey. The charges were that bribes were paid to an employee of a state-owned company in exchange for a contract to perform oil-related services in Columbia. The General Counsel of the company had previously pleaded guilty to conspiracy to violate the FCPA in connection with the scheme, and had turned informant (wearing a wire at the behest of federal authorities to record incriminating conversations).

The SEC and DOJ will also go after relatively small violations. For example, on July 28, 2014, the SEC announced a settlement with Smith & Wesson (Springfield, MA) for $2 million (including a $1.906 million penalty). Smith & Weston was alleged to have hired a third party agent in Pakistan to help the company sell guns to a local police department. Smith & Wesson allegedly authorized the agent to provide approximately $11,000 worth of guns to Pakistani police officials as gifts, along with cash payments, in exchange for which Smith & Wesson won a contract to sell 548 pistols for a profit of $107,852. The order also described similar conduct in Turkey, Nepal and Bangladesh although no sales contracts were secured there.

There are two affirmative defenses and one exception in the FCPA. The affirmative defenses are that the payment was lawful under the written laws of the foreign country, and that the payment was a reasonable and bona fide expenditure (such as a hotel bill) incurred on behalf of a foreign official directly related to the demonstration or explanation of a product or service or performance of a government contract. The latter defense is construed very narrowly by the government, and any such expenses must be audited and controlled and documented tightly by any company relying on this defense. The law also excepts “grease” or “facilitating” payments made to expedite or secure performance of a routine, non-discretionary governmental action (like the provision of electrical service). Use of the “grease” or “facilitating payment” exception is fraught with risk, both because such payments are often illegal under other laws and because the exception is construed so very narrowly. The DOJ and SEC have publicly signaled that they discourage the practice of making such payments, and the ethics policies of many companies prohibit them altogether.

There is no question that bribes, kickbacks and unrecorded transactions are common in many foreign countries. Some U.S. businesspeople believe that “you can’t do business in certain foreign countries without paying bribes.” This is dangerous thinking, particularly in the current environment of ramped up enforcement both by the U.S. and by foreign governments. It is no different than speeding or running a traffic light in a situation where you know that law enforcement is cracking down – sure, others might be doing it, but there is no certainty that you will get away with it, particularly with police on almost every corner!