The State Of Manufacturing: A Positive Outlook

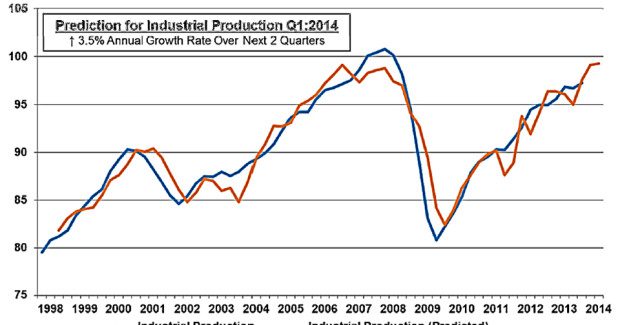

Slowing global growth, domestic fiscal uncertainties, higher taxes, and other persistent headwinds in the economy have spurred weaknesses in the manufacturing sector. However, with the recent uptick in activity, Dr. Chad Moutray of NAM explains why there is reason to be positive about the outlook for an ongoing manufacturing renaissance in the U.S..

Posted: January 7, 2014

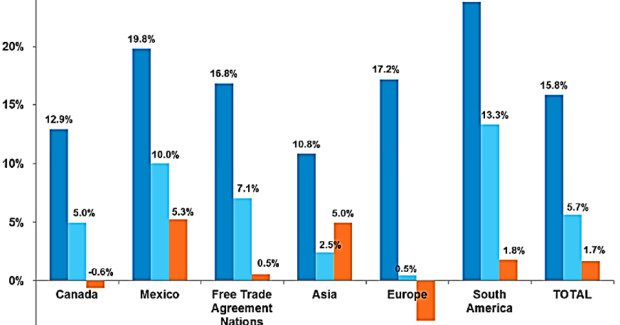

Another reason for optimism is the rebounding global economy. There is increased confidence in Europe, which accounts for roughly 20 percent of U.S. exports. And some stabilization of the Chinese economy is helping to lift the rest of Asia, which is further cause for optimism. Although there may not be strong international growth on the whole, it is positive growth nonetheless. This should bode well for U.S. exports going forward.

MANUFACTURING TREND THREE: POSITIVE ECONOMIC INDICATORS

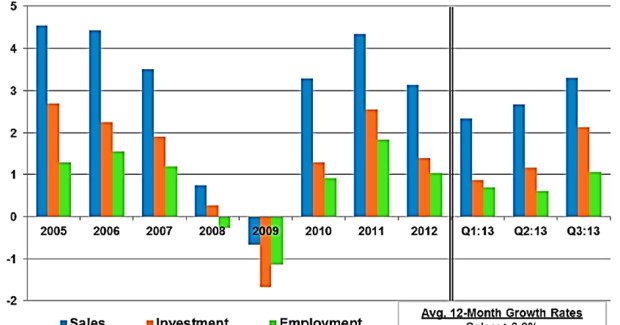

Positives in the economy as a whole include consumer spending, housing, low inflation, increased energy production, and productivity gains. The challenges caused by the fiscal cliff and budget issues have taken a bite out of the confidence of both consumers and small businesses, but surveys of both indicate rising confidence over the course of the year.

Factors supporting strong consumer spending include the low interest rate environment, household debt service expense as a percentage of disposable income at very low levels historically, and the so-called wealth effect from rising stock markets and house prices. At 70 percent of GDP, consumer spending has helped to buoy overall GDP growth since the recession, a trend that should continue moving into 2014.

Consumer spending was up roughly 3 percent in the second quarter of 2013 and modest growth continues. This lifts the general economy in terms of GDP. In addition to growth in consumer spending, housing and business spending were trending up as well. In fact, consumer spending and investment contributed 2.7 percent growth to second-quarter GDP of 2.5 percent (this means that exports and government spending pulled the GDP number down slightly).

The housing market has been one of the brighter spots in the economy. We surpassed one million housing starts in the spring. The recent dip we are experiencing is due to “sticker shock” in the mortgage market. Mortgage rates have increased by more than a percentage point in the last year, causing consumers to expedite closings or to pull back from buying.

Once buyers get past the shock and accept the new normal for mortgage rates — likely to be 5 percent in 2014, which is still historically low — there will be further growth and a return to housing starts above one million.

MANUFACTURING TREND FOUR: POLICYMAKERS CONTRIBUTE TO UNCERTAINTY

Manufacturers are very concerned about the long-term economic and political environment. The most pressing issue for manufacturers remains the rising cost of health care. Seventy-five percent of the NAM’s members cite rising health care costs as their top challenge today, primarily driven by the uncertainty of implementation of the Affordable Care Act.

The second most pressing challenge is the unfavorable business climate — taxes, regulations, and government uncertainties.

When the NAM asked their members the top policies they would like to see addressed in the next 12 to 18 months, the need to address a long-term fiscal solution comes through loud and clear as the top priority with agreement from 85 percent of respondents. Although four of the top five policies are intertwined with budget and cost issues, reducing the regulatory burdens placed on manufacturers is top of mind as well.

Another concern is the exit strategy for the Federal Reserve from its ongoing monetary stimulus program, Quantitative Easing (QE). There is a moderate degree of worry regarding how the Fed plans to unwind (“taper”) the soon-to-be $4 trillion in assets on its balance sheet, an unprecedented number even in recent history.

What to Watch for as We Move into 2014

As manufacturers plan for 2014, there are a number of issues that are likely to impact business, either directly or indirectly:

(1) Janet Yellen will take over the Federal Reserve on February 1, 2014. The tapering of asset purchases by the Fed could begin as early as the December Federal Open Market Committee meeting, but the easing in buying will more likely be pushed into early 2014.

(2) I am currently forecasting 2.8 percent growth. Yet, the U.S. could see GDP growth of as much as 3 percent next year — the first time since 2005. For this growth rate to materialize, consumer and business spending would need to pick up, and the export market would need to recover.

(3) The unemployment rate is expected to fall below 7 percent before the end of this year — a level we have not seen since November, 2008. Some estimates indicate unemployment may reach as little as 6.5 percent by the fourth quarter of 2014.

(4) We expect consumers to become accustomed to higher mortgage rates, but it is still important to watch how the housing market reacts to higher borrowing costs.

(5) 2014 is going to be a big year for free trade — the Trans-Pacific Partnership (TPP), the Transatlantic Trade and Investment Partnership (TTIP), and the Export-Import Bank Reauthorization are all due to pass.

(6) The ramifications of the Affordable Care Act are still unclear — on both business and overall employment. Because the employer mandate was pushed back, the full impact and ability to evaluate its effect will also be delayed.

(7) The American Chemistry Council (ACC) estimates that there are currently 128 announced projects tied to shale, equating to a total $85 billion in investments. Although the lead time for the impact of these investments to be realized is long, the U.S. could begin to see some benefits in 2014.

(8) The Boston Consulting Group estimates that 600,000 to 1.2 million manufacturing jobs will be added by 2020, as the U.S. becomes a more viable location for investments. While lower energy contributes to this figure, other factors leading to this resurgence in manufacturing include lower relative labor costs, advances in quality, and higher transportation costs.