2014 Tooling & Workholding Outlook: Reduced Process Variability

Jack Burley of BIG Kaiser explains why tooling strategies should focus on ways to reduce downtime during production due to process variables, such as time to compensate for insert wear on a boring bar or changing a perishable tool such as a drill. Offline tool presetting and zero point clamping systems are a natural part of the methodoogy for keeping spindles rotating and machine tables moving as much as possible.

Posted: January 10, 2014

The current state of business remains stable, neither increasing or decreasing. Some sectors are increasing, but others are decreasing and seem to be offsetting each other, resulting in somewhat stable or flat business.

Aerospace and automotive are very strong, but products related to the construction and fossil fuel industries in China have reduced demand considerably. Aerospace customers are increasing productivity with new equipment that requires dual contact tooling.

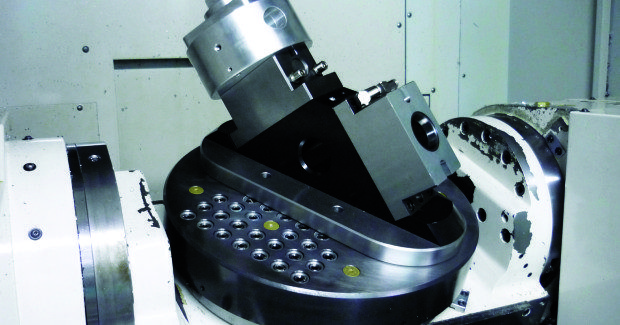

Tool holders must be heavy duty in design for high bending strength, able to pass maximum coolant volume through the tool, with nearly perfect runout accuracy. The automotive industry has really improved process reliability and ease of use for unskilled operators by using digital boring heads.

Most manufacturers have been able to reduce costs as much as possible in all areas of their operations, including power consumption, raw materials, and logistics. The tougher challenges to compete with what remains are machine tool burden rates driven by the shortage of skilled operators to use them effectively.

Not to beat an old drum, but cutting tool costs as a percentage of total cost of production is still very low (less than five percent, depending on the workpiece material). If a company purchases cheap tooling to try and save on costs, they don’t see the downside of this strategy. A $200.00/hour machine sitting idle while your highest paid machinists ‘babysit’ production due to tool breakage, wear, or poor process repeatability quickly reduces any competitive edge gained by buying cheap tooling.

Instead, tooling strategies should focus on ways to reduce downtime during production due to process variables, such as time to compensate for insert wear on a boring bar or changing a perishable tool such as a drill. Offline tool presetting and zero point clamping systems are a natural part of the methodology for keeping spindles rotating and machine tables moving as much as possible.

Labor cost and tax burden is a major issue, despite our gains in productivity due to automation. Our federal, state, and local governments must be proactive to keep manufacturing a viable industry by tax incentives for investments, educational scholarships for future workforce needs that use new technology, and fair trade agreements from abroad.

We have a huge entrepreneurial spirit of workers who adapt to change and progress very quickly and easily; it’s important that we don’t condemn progress and innovation through over-regulation by the government.

Local manufacturing companies, even those who are competitors with one another, need to work together in conjunction with local schools and elected officials to get properly educated workers who can make a difference starting with their first day of employment. Finding and training today’s workforce is a community commitment, with everyone participating equally to achieve the desired pool of workers to choose from.

Personal transportation and driving habits will change radically over the next 20 years. After more than a century, the use of gasoline-powered cars will be replaced by hybrid vehicles that can navigate themselves. The technology behind these changes is occurring in areas of the country that are not typical for this type of industry. Look at where our computers and hybrid technology originate – namely the West coast – and you can foresee how this area will become the new Detroit of automobile design and development.

However, though production for this new class of technology remains to be seen, it will likely be located in some very non-traditional manufacturing regions closer to the sources of raw materials they use.