The Internet of Things

Want to know what lies ahead in manufacturing? Markus Löffler and Andreas Tschiesner of consulting

firm McKinsey & Company share some valuable insights from executives at Robert Bosch who discuss the technology-driven changes that promise to trigger a new industrial revolution that will affect how your shop operates — and competes.

Posted: November 8, 2013

"Most companies think of physical flows of material components through the supply chain as separate from information flows. They consider how and where to coordinate and synchronize them. Eventually there will no longer be a difference between information and materials, because products will be inextricably linked to “their” information."

"Supply-chain integration will play a decisive role in new operating models. The point is to completely integrate all relevant information into this chain. We are still a long way off, but it will be fascinating to see whether even large supply-chain operators will be able to keep pace with the speed of technology."

"In the future, unfinished material will know which customer it is intended for and carry with it all the information about where and when it will be processed. Once the material is in the machine, the material itself will record any deviations from the standard process, determine when it’s “done,” and know how to get to its customer."

"The next big step will be to think through the interdependencies among the machine, the production components, the manufacturing environment, and the IT that connects it all, so that the production technology controlling the machines merges with the technical data of the components. This requires a high degree of standardization so that the machine knows what it needs to do to any given component, and the components can confirm that the machine has done it. Such IT linkage goes far beyond current manufacturing systems."

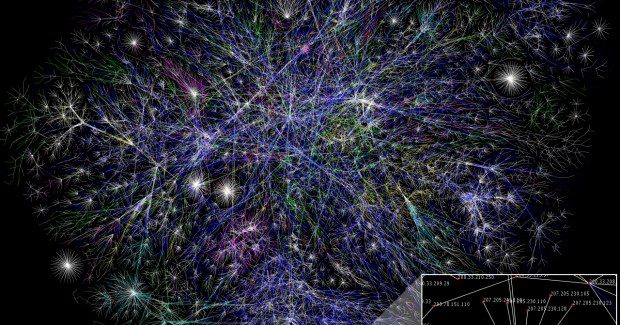

It’s called the Internet of Things, where our physical world is becoming a type of information system — through sensors and actuators embedded in physical objects and linked through wired and wireless networks via the Internet Protocol.

In manufacturing, the potential for cyberphysical systems to improve productivity in the production process and the supply chain is vast. Consider processes that govern themselves, where smart products can take corrective action to avoid damages and where individual parts are automatically replenished. Such technologies already exist and could drive what some industry leaders call the fourth industrial revolution — following the steam engine, the conveyor belt, and the first phase of IT and automation technology.

What opportunities and challenges lie ahead for manufacturers — and what will it take to win? To discuss the future of manufacturing, we recently sat down for a conversation with Siegfried Dais, the deputy chairman of the board of management at German engineering company Robert Bosch GmbH (Stuttgart, Germany), and Heinz Derenbach, the chief executive officer of Bosch Software Innovations GmbH (Berlin, Germany).

A NEW ERA FOR MANUFACTURING AND LOGISTICS

Löffler: The Internet of Things has already set in motion the idea of a fourth industrial revolution — a new wave of technological changes that will decentralize production control and trigger a paradigm shift in manufacturing. My question for the group is how do we think this paradigm shift will affect the classic production process and the manufacturing value chain?

http://www.youtube.com/watch?v=OxyBso5HDDI&

Based on the components of its system and service platform, Bosch Software Innovations demonstrates a security application for large, commercial buildings and premises. Dirk Slama, member of the Bosch Software Innovations product management team, shows how the combination of device, data, rules and process management builds up real world internet of things applications.

Dais: Given the Internet of Things — or Industry 4.0 as we call it when referring to manufacturing production — it is highly likely that the world of production will become more and more networked until everything is interlinked with everything else. And logistics could be at the forefront of this shift.

Tschiesner: I agree. And it will make logistics and the supplier network grow enormously more complicated. Although lean manufacturing can certainly reduce inventories, manufacturers will need to coordinate with more and more suppliers — often globally, and with longer transport times, more manufacturing steps, and significantly more parties.

Dais: Right. If a plant implements lean manufacturing, it keeps stocks to a minimum — not one part too many or too few. Components are constantly traveling the planet, often arriving within a day. With the Internet of Things, this system must extend beyond the limits of indi vidual factories to interconnect multiple factories and even regions. Now the questions become who will do this? How do we find an architecture that is stable enough to keep everything networked together?

I think it will primarily require algorithm specialists and software architects. We will need “steering instruments”— new algorithms and applications that interlink millions of things, that ensure that everything runs stably, and that are synchronized across the entire value chain.

Tschiesner: So how do we assess our existing logistics systems and identify the gaps? Let’s take container logistics in maritime shipping, which might be considered almost Stone Age in view of what is to come. It will be a tremendous effort to bring container logistics into the next generation of manufacturing.

Dais: To really drive developments, two competencies must come together. First, we need to recognize the change potential, value creation, and cost reductions we can achieve if we apply what’s actually “new” about new technologies. For example, take cyberphysical systems that can tell us where every single unit is at any given time. Logistics players often use this tool, but with an old mind-set that fails to exploit the advancements the tool was designed to offer.

So the first requirement is that logistics players truly use what’s new. The second competency is finding people who are able to design robust algorithms: those who make the system user-friendly so that the people who use it day-to-day can immediately recognize problems and know how to react without getting tangled up in a web of interdependencies.

Derenbach: One core element is the ability to create models. It is essential to translate the physical world into a format that can be handled by IT. This requires mathematical, domain, market, and context know-how. In the connected world, we cannot separate the physical world from business processes. We capture this in the slogan “process2device.” This means a physical device becomes an active part of a business process: delivering data, sending events, and processing rules. This notion is driving us.

FUSING PROCESSES AND DEVICES

Löffler: Most companies think of physical flows — meaning the flow of material components through the supply chain — as separate from information flows, and then consider how and where to coordinate and synchronize them. After the fourth industrial revolution, there will no longer be a difference between information and materials, because products will be inextricably linked to “their” information.

Dais: Right. For example, a piece of metal or raw material will say, “I am the block that will be made into product X for customer Y.” In an extreme vision, this unfinished material already knows which customer it is intended for and carries with it all the information about where and when it will be processed. Once the material is in the machine, the material itself records any deviations from the standard process, determines when it’s “done,” and knows how to get to its customer. It might not happen right away, but things will definitely move in this direction.

Löffler: That would mean that mechanical engineering would also be inseparable from IT.

Derenbach: Exactly. I don’t think that competencies can be mixed at will, but we do need new forms of interdisciplinary collaboration. The next big step will be to think through the interdependencies among the machine, the production components, the manufacturing environment, and the IT that connects it all, so that the production technology controlling the machines merges with the technical data of the components. This requires a high degree of standardization so that the machine knows what it needs to do to any given component, and the components can confirm that the machine has done it. Such IT linkage goes far beyond current manufacturing systems.

Löffler: That’s an interesting point — what happens is a complete consolidation of devices and process management. “Process and device” will be inseparable; physical things become part of the process. What this means for the plant is that machines and work flows merge to become a single entity. The work flow ceases to exist as an independent logistical layer; it is integrated into the hardware.

Tschiesner: This idea can be taken even further — if existing machine capacities only work through components on order, does it even matter who owns the assets? In other words, will we experience a trend in plants similar to what we have seen in cloud computing, where the customer purchases only virtual capacity?

Dais: Quite possibly, and it would change the business of manufacturing completely. For certain products, this trend is already becoming apparent. But it won’t happen overnight.

Löffler: With these radical changes looming, who has the best chance of controlling the profit pool — those with the production technology or those who own the assets?

Dais: I would take a step back and ask, in the mind of the consumer, who represents the final product? The designer? The manufacturer? Or the person who created the contract with the customer for the final product?

Tschiesner: Right. This takes us into the field of contract manufacturing.

Dais: Design companies have already separated design and production. They create products or solutions for customers but do not produce them; they simply provide the specifications to contract manufacturers, who then handle production. This trend of separating design and production will continue to spread across other industries and sectors.

SUPPLY CHAIN INTEGRATION: WHAT’S IN STORE

Tschiesner: I think supply-chain integration will play a decisive role in new operating models. The point is to completely integrate all relevant information into this chain. We are still a long way off, but it will be fascinating to see whether even large supply-chain operators will be able to keep pace with the speed of technology.

Dais: With all this new information available — about interdependencies, the flow of materials, the cycle time, and so on — manufacturers can lower their inventory costs and reduce the amount of capital required. But don’t forget: this involves huge amounts of data, and the fundamental prerequisite for such a system is that it is stable and reproducible. Common sense won’t help here; this involves rigorous mathematics. And what’s interesting is that the algorithms for this already exist. Mathematics has already solved numerous problems that we won’t encounter in the real world for another 50 years.

But analytical talent is becoming increasingly rare in the labor market, so there will be fierce competition for mathematicians and analysts. The opportunities presented by the Internet of Things are clear — but so are the challenges.

Markus Löffler is a principal in the Stuttgart, Germany, office and Andreas Tschiesner is a director in the Munich, Germany, office of McKinsey & Company, Inc., 55 East 52nd Street, New York City, NY 10022, 212-446-7000, www.mckinsey.com.

Note:The authors wish to thank Oliver Bossert for his contributions to this article.