Machine Production Rebounds to Record Revenue, Should Rise Through 2014

The machine sector was among the hardest hit by the economic downturn, but this year is set to be a record for worldwide machinery production with 10.2 percent aggregate growth – a trend forecasted to continue for at least the next three years.

Posted: December 12, 2011

The machine sector was among the hardest hit by the economic downturn, but this year is set to be a record for worldwide machinery production with 10.2 percent aggregate growth – a trend forecasted to continue for at least the next three years.

This is set to be a record year for worldwide machinery production, which has recorded 10.2 percent aggregate growth year-to-date according to IMS Research (Wellingboro, UK), the leading independent provider of market research and consultancy to the global electronics industry. In a report titled, “Machine Production Yearbook – 2011” the data points to the fact that this trend is forecasted to continue through the forecast period to 2014.

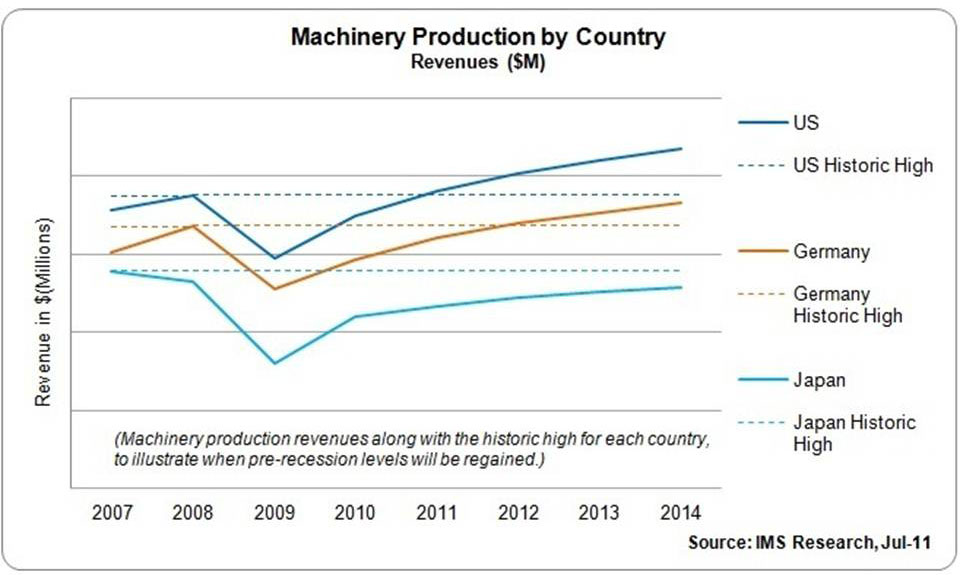

The machine sector was amongst the hardest hit by the economic downturn, and given the long-lead nature of the business – it was also one of the last to suffer. However, worldwide production of machinery is set to eclipse its previous record that was originally set back in 2008. “The latest indicators are that growth is slowing slightly from the highs seen last year – hardly surprising when you consider the magnitude of the bounce back seen in 2010 – but there still appears to be solid growth on last year. This should, of course, be encouraging news, however, when output is considered on a regional basis, the contrast is striking,” says Andrew Robertson, a market analyst for IMS Research.

Output from the Asia-Pacific region declined in 2009, but not to the extent as in Europe and the Americas. And while Japan’s output plunged in 2009, China and India continued to see growth. But helped by tremendous growth in Japan in 2010, the Asia-Pacific market comfortably surpassed its 2008 levels last year, and looks set to continue its strong performance.

In the Americas, where machinery output is still dominated by North America, the decline in 2009 was more severe and the subsequent recovery more gradual. That said, the recovery has been such that 2011 is predicted to be a record year for machinery production.

Meanwhile, the 2009 downturn in Europe was more severe than in the other two regions, and recovery has been more varied. Although Germany’s upturn has been fairly strong, the plight of others such as Spain, Greece and Portugal has been widely documented. As such, IMS does not anticipate that machinery production in Europe will surpass the pre-recession level until after next year.

Figure 1 below illustrates the varying performance of the three nations which have traditionally dominated the machinery sector. Whereas machinery production in Germany and the U.S. recovery are preparing to set record-breaking years relatively quickly after the downturn, the outlook in Japan is in stark contrast. The Japanese industry plummeted in 2009 and at present the outlook is still uncertain. As such, even with growth in 2010 of almost 40 percent, production is still not expected to recover to pre-recession levels before 2015.

“Although no industry is immune from the effects of the current economic uncertainty, machinery output – for the time being at least – appears to be faring better than the other markets and economy in general. Whether it will continue to do so is yet to be seen,” adds Robertson. www.imsresearch.com